In this article, we are going to talk about the best app for borrowing money ever: The One that can satisfy your financial needs. Borrowing money has become easier and more convenient with the rapid change in technology.

The best app can be a game changer if you need money for emergency expenses, bills or even to chase dreams. As we look at different apps, I will compare them on various factors such as rates offered; ease in use and trustworthiness among others so as to come up with which one is better than others according to me. Thus;

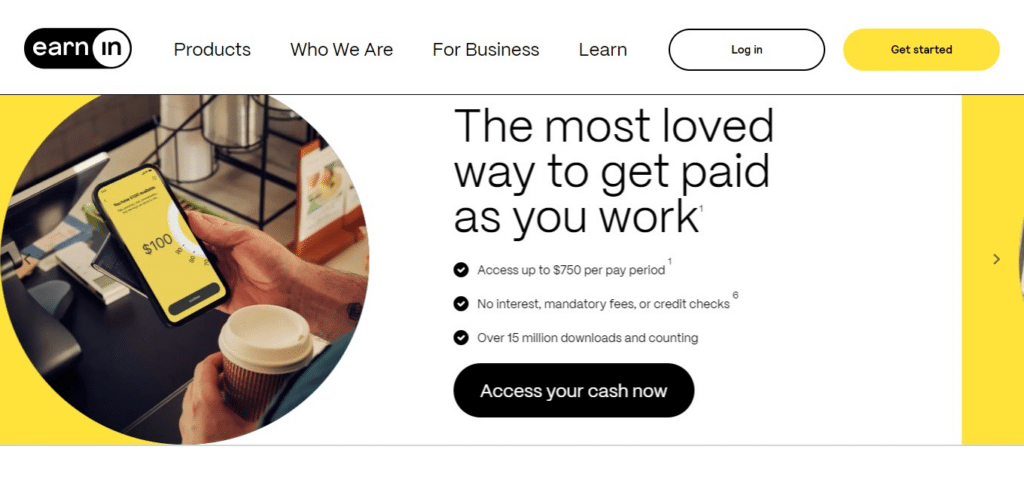

1- Earnin

Because if its unique method, Earnin is an unusual selection for borrowing money. The app allows you to get your unpaid earnings prior to the payday which is very helpful for individuals who live from hand to mouth. With it, one can save themselves from getting into a debt trap of expensive overdrafts or high interest payday loans.

Besides, it is not difficult to use; all you need do is link your work and bank account details then whenever necessary request for a paycheck advance. Moreover, they don’t charge any fees neither do they take interest but instead operate under ‘pay what’s fair’ where users may tip the service if desired.

This kind of openness coupled with versatility has made Earnin quite popular among those seeking equitable and convenient means through which they can access cash before their next salaries.

2- Cash App

Cash App is one of the best borrowing apps because it can be used in many different ways and is really helpful. Apart from being able to send money to other people, there is also a cash advance feature on Cash App that allows you to borrow small amounts of money fast and easily.

It doesn’t matter if you need some extra cash for unexpected bills or until your next paycheck comes through – they’ve got you covered at Cash App. It’s as easy as pie; all you have to do is ask for an advance right from within the app itself, and if they approve it (which usually happens pretty quickly),

BAM! The funds get deposited into your Cash App account immediately. And unlike most other lenders out there, these guys don’t even check your credit score before giving them up – so anyone can use ‘em! With its simple design, intuitive interface, quick funding timescales and overall great customer service record – I’d say this little beauty has got all bases covered when we’re talking about getting our hands on some much-needed cash in a hurry!

3- Dave

Dave is considered one of the best borrowing apps. This is because it helps to avoid expensive overdraft fees by advancing small amounts against your paycheck when needed. With Dave, you can rest easy knowing that there’s a back-up for unexpected expenses or emergencies.

The app studies your spending habits and income streams so as to offer personalized insights and predictions that keep you in control of your money. It has an interface that anyone can navigate through easily; also, approvals are very fast making borrowing money quick and simple.

Furthermore, unlike charging interest like others do, Dave operates on subscriptions -monthly fee- basis which makes this service cheaper for people looking for financial flexibility than any other such platform around today. For its dedication towards financial independence as well as introduction of new tools designed specifically for this purpose alone Dave deserves every bit of trust placed upon it by millions worldwide who consider their relationship with money personal!

4- Brigit

If you need to borrow money or require assistance with unexpected expenses, Brigit is a great choice. This service offers advances of up to $250 for paying bills, avoiding overdraft fees and dealing with any financial emergency that may arise before payday.

However, Brigit is unique among similar apps because it focuses on keeping things simple and clear; this means that it evaluates your spending habits and income in order to provide you with personalized advances based on what you need and can afford at the time.

On top of that, Brigit does not charge interest or fees for its core features which makes it cheap for most people who use them regularly. The easy-to-use interface coupled with their commitment towards giving timely financial aid has made Brigit become trusted by thousands as a reliable partner in taking back control over one’s personal finances while they await their next paycheck.

5- Chime

Chime is typically considered one of the best borrowing apps, offering many features for financial flexibility and security. Chime allows users to get early direct deposit, which means they can receive their paycheck up to two days earlier than other banks.

Another feature that makes Chime unique is SpotMe; it lets qualifying customers overdraw their account without being charged a fee. This comes in handy when you have unexpected expenses or are low on cash before payday. The mobile app is easy to use and navigate while applying for money is made quick and easy through an intuitive interface at Chime.com.

They strive toward helping people help themselves financially but not only do they want them empowered by taking control over their own finances they also don’t want them getting hit with expensive fees along the way so this has earned Chime trust within industry circles as being reliable when it matters most during times where one may encounter financial troubles such as these!!

6- Branch

Among borrowing apps, Branch is a standout choice. It creates a bridge between paychecks using its creative features and easy-to-use interface. The company allows up to $500 as advances for unexpected expenses or the time gap between two salaries.

But what makes Branch different from others is its dedication towards financial wellness – it doesn’t just give out loans; there are also some budgeting tools and insights provided within this app which might be helpful for managing money better in future life. Whether one needs few more dollars to cover bills right now or wants to save on overdraft fees tomorrow, Branch can do all these things too.

Not only does it take little time before approval comes through but the fee system is made very clear so that everyone knows what they’re getting into when borrowing from them. With such supportive technology at hand like this one here called ‘Branch’, any person can be sure about their abilities while dealing with monetary matters of life.Directory: 1.50

7- Affirm

Affirm is a popular loan app renowned for its easy “buy now, pay later” service which allows people to finance their shopping over time. Affirm lets you buy things online and settle the payment in installments with fixed monthly dues and clear interest rates.

This enables buyers to purchase expensive products or split the cost of shopping without relying on high-interest credit cards or loans. Late fees and prepayment penalties are not charged by Affirm, whose approval process is simple enough that you can have access to funds within minutes.

With an intuitive interface designed for users at any level of tech-savviness combined with honesty about how it lends money, this company becomes a trustworthy choice among those who want convenient ways to make purchases while staying financially responsible.

8- SoFi

SoFi is a great app for borrowing money because it allows individuals to take personal loans at low-interest rates and on flexible terms. Whether you want to do home improvement, consolidate your debt or cater for unforeseen expenses;

then this is the right place for you. What makes Sofi unique among other apps of its kind, is that it empowers people financially through education–they provide all necessary resources needed alongside tools which can assist users to make good financial decisions as well as improve their overall well-being in relation to finances.

You can apply entirely online with sofi for a loan and if approved, you will receive your money fast. On top of this, there are more benefits such as career coaching among others exclusively offered for members by Sofi thus making them even more valuable than what they already offer!

With visibility into fees charged by competitors combined with low rates based off strong credit scores; personalized support whenever it’s required – SoFi becomes one’s best friend when striving towards financial success without worry or doubt.

9- LendUp

LendUp is a great choice for borrowing apps because it improves credit scores and helps users with their financial position. LendUp offers short-term loans that don’t require standard credit checks, so a lot of different people can use them.

What makes LendUp different from others is its transparency to customers and commitment towards responsible lending – they clearly state terms and conditions on the app itself and also provide educational resources for better understanding personal finances. Another good thing about LendUp is that it allows customers to earn points through its “

LendUp Ladder” program which in turn may lead to lower rates of interest being charged as well as higher amounts allowed to borrow over time. With financial literacy at heart coupled with equitable borrowing opportunities plus positive credit bureau reporting; this makes lend up our trusted partner when dealing with money woes.

10- Upstart

Upstart is a lending application that’s considered top-notch because of how much it differs from traditional lenders. It accomplishes this by using AI to assess credit worthiness, thereby enabling the company to make personalized loan offers with competitive rates.

If someone needs money for debt consolidation or any other reason related to their finances, they can get personal loans through Upstart based on their individual financial circumstances. But what really makes Upstart stand out among other lenders is its willingness – and even eagerness – to take into account things like education level and work experience when deciding whether or not somebody should be extended credit.

People who don’t have much credit history or who find themselves in unique situations may still be able to qualify for good terms on loans because of this fact alone. Additionally, the approval process doesn’t take long at all nor does getting funded which means if you need cash quickly this might be your best option yet.

They are helpful in technological terms as well; Upstart uses technology so as not only provide but also ensure fair lending opportunities thus making it easy for anyone with any financial goal in mind partner together knowing very well that they will achieve them soonest possible being served by such organizations which use knowledge advancements while delivering services.

How I Picked Best App To Borrow Money For You

Here’s what I did to choose the best app for borrowing money on your behalf:

Ratings and Reviews: I looked at user ratings and reviews from different platforms to find out how satisfied people are with these apps generally and whether they can be trusted.

Characteristics and Advantages: Every application has its own unique selling points or features designed specifically for convenience when taking loans like limits of cash advance amounts, terms of repayment interest rates charged etcetera also value added service may include better credit scoring tools which help you build up.

Simplicity: It should be easy enough for anyone who wants one to understand how it works at first glance so that there is no need going through lots instructions before getting started – besides being user friendly in terms navigation.

Costs Involved: The cost associated with borrowing through the service should not go beyond what has been agreed upon because some of them might charge high rates, fail to disclose other hidden fees such as late payment penalties or even sign you up for a subscription without your consent – all these things need careful consideration when selecting an appropriate provider among many available options.

Availability & Requirements: Some applications may only require good credit while others demand proof income but either way ensure that one cannot access money too easily without meeting certain eligibility criteria like having a job where salary can be verified; on top location which should also considered so that getting funds becomes possible whenever needed most urgently especially during emergencies

Customer Care Services: Look into quality customer support services offered by companies behind these lending platforms e.g., response time taken before replying back messages sent via email/chat box etc.; channels used communication purposes i.e live chat feature phone call option availability FAQs section should addressed promptly.

Uniqueness & Modernity: If there any additional features set apart from competitors then check if they bring value added benefits this could done using artificial intelligence make quick decisions based on past behavior patterns when dealing lender clients plus providing predictive analysis future defaults trends among others; therefore consider only those companies that have shown remarkable growth potential through innovation.

Credibility: Some firms may have faced legal tussles which tarnished their name hence such matters ought looked into while selecting which platform to use this will help in ensuring safety for personal information shared during sign up process among other things.

When Choosing a Best App To Borrow Money What Is Look For?

For the selection of the most suitable app for borrowing money, there are a few things that we need to consider.

Interest Rates: Take a look at some apps with good interest rates so that you will not have to pay more than what is necessary for your loan.

Fees: Give attention to fees like origination fees, late fees and prepayment penalties etc., which may come up during borrowing. Transparent fee structures should be adopted by apps in order to evade any hidden surprises.

Loan Terms: Think about every app’s offered loan terms including the repayment period and if they allow payment rescheduling or not.

Accessibility: You should check whether you meet all requirements set out by an app for one to qualify for lending money from it. Some may require higher credit scores or greater incomes than others do.

Speed: Immediate approval and funding processes are what one looks for in apps when they need fast access to funds.

Reputation: Look into how well known this particular application is and also read through some reviews made by different people who have used them before just so that you get an idea about what kind of experience others had with it whether positive or negative

Customer Support: In case of problems faced while using these services or questions arising, consider availability as well as quality levels shown by App Provider towards its customers

In The End

Eventually, the top app for borrowing money depends on your specific financial situation, preference and ability. It is important to look at things such as interest rates, charges, terms of the loan, availability of loans,

reputation, support from customers, security measures taken by the platform among other features that may be useful or flexibility when making a decision. By considering these factors carefully as well as doing some research into what’s available out there you will find an option which suits your needs best while also ensuring reliability in borrowing money through transparency.

The correct application can empower competitiveness in pricing settlements or fast cash injections even if it does not offer good quality services thus you should always select wisely.